-

I hear that tourist real estate prevents year-round residents from finding accommodation?

In February 2022, the Government requested the establishment of an interministerial mission in order to assess tensions on housing markets in tourist areas (excluding metropolitan areas) and to identify measures to combat the eviction of certain active households, particularly the less well-off, to access a primary residence in these tense areas.Apart from measures intended for communities, the report recommends three developments for furnished rentals:Apply energy performance criteria to all housing rentals.Make the taxation of furnished rentals less attractive.Open the possibility for all municipalities to implement change of use regulations (which does not mean a ban).The report identifies many other avenues and the fact that the implementation of regulations, which are all restrictions on fundamental rights, must be based on factual and objective elements.Regardless of the report's recommendations, it is quite likely that in the medium term all housing, whatever its use, will be subject to energy performance criteria, due to global warming.Even if income from furnished rentals is more heavily taxed, it will always be more interesting to receive it than to do without it.Finally, if an owner wishes to keep the use of his second home, what is the point for a municipality to favor its emptiness, by prohibiting the change of use, rather than favoring the economic benefits of tourism, which are moreover more regular throughout the year? -

How to manage possible damage?

They are covered, initially, by the tenant's deposit, which is recorded when booking. Problems are rare, because it is now possible to inform the reservation platforms of the indelicacy of certain tenants.Sérénissime has chosen the Swikly solution: the deposit request is not debited and does not impact the travelers' bank card limit. In the event of damage, Swikly allows you to cash all or part of the deposit in a few clicks.Depending on the damage, the property's insurance may also be involved. -

Who pays the charges (heating, water, electricity)?

They are not billed in addition to the cost of the stay, they are integrated into it. -

How to insure a seasonal rental as an owner?

It is possible to take out several types of guarantees to be covered against rental risks:Non-occupying landlord insurance or PNO: Non-occupying owner insurance has many advantages for insuring accommodation in the context of rentals and compensating the occupants.A guarantee of recourse for tenants against the owner: this guarantee protects owners when the lack of maintenance of a property is the cause of damage suffered by a tenant. The guarantee, for example, covers damage caused by poor pipe maintenance.Insurance for the benefit of any tenant: these specific home insurance contracts can offer guarantees to all your tenants.To go further: please contact your insurer to find out their prerogatives. -

Why put my property up for short-term rental?

Short-term rental has three advantages:It does not deprive you of the enjoyment of the property when you wish to occupy it during your vacation, unlike long-term rental.It allows you to obtain additional income with better profitability than long-term rental, the rents being higher. However, they are accompanied by a greater risk of rental vacancies. This is also linked to the tourist attractiveness of the property. On the other hand, the risk of non-payment disappears because rental of furnished tourist accommodation provides for prepayment.It allows your accommodation to be occupied and maintained all year round, without experiencing long periods of vacancy, which could be detrimental to it in the Breton climate. -

What are the revenue prospects?

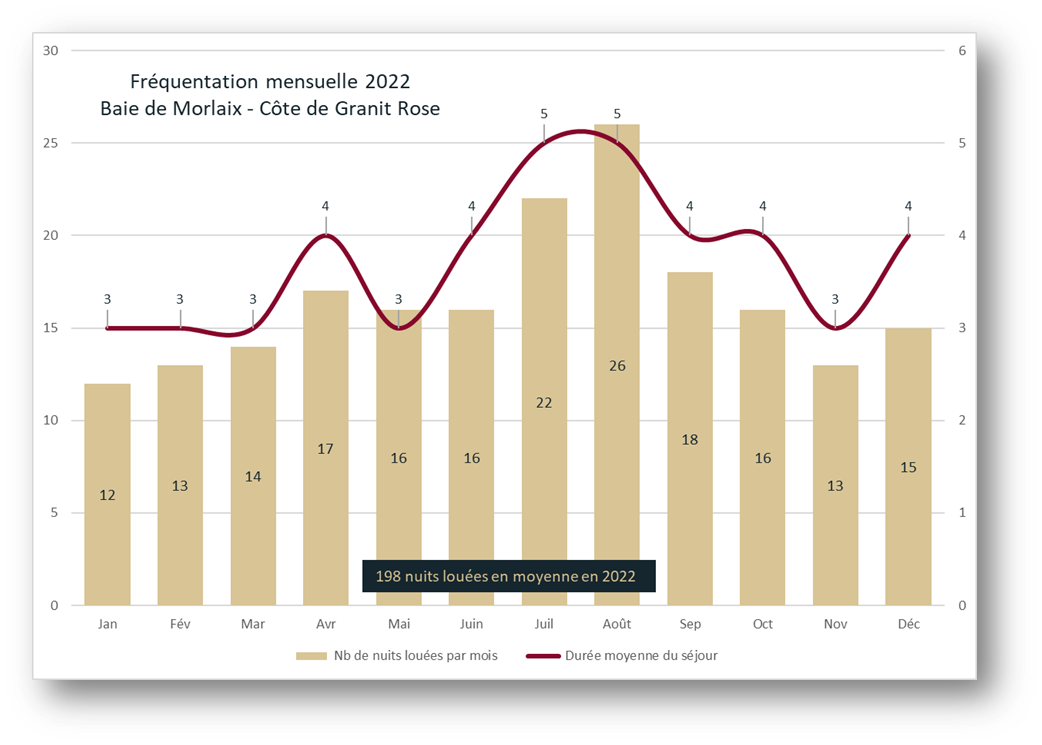

It is impossible to answer this question precisely without identification. Indeed, its location, its size and its equipment will influence the pricing policy.However, we can refer to the average attendance of furnished tourist accommodation in our territory:

This graph demonstrates the importance of the low season (51% of nights rented are from October to April) and the capacity to accommodate short stays. -

What are the administrative obligations?

Administrative obligations are few and free:An entry in the INSEE Sirène directory.A declaration of the tourist accommodation to the town hall using the Cerfa form n°14004. -

Qu’en est-il de la fiscalité ?

D’un point de vue fiscal, les revenus issus de la location saisonnière bénéficient du même régime que la location de tout logement meublé.Ces revenus sont soumis à l’impôt sur le revenu et leur modalité d’imposition dépend du montant de vos recettes annuelles :Pour des recettes annuelles inférieures à 72 600 € HT, vous pouvez choisir entre le régime réel ou le régime dit « micro-BIC ». Ce dernier, plus simple, vous permet de bénéficier d’un abattement automatique de 50 % sur vos revenus locatifs.Pour des recettes annuelles égales ou supérieures à 72 600 € HT, vous devez opter pour le régime réel et pouvez déduire l’ensemble de vos charges selon les dépenses réellement engagées.Pour aller plus loin : https://www.economie.gouv.fr/particuliers/location-meublee-declaration-revenus-impot